CSRD Reporting Beyond Compliance: Building Robust Data Governance for Sustainable Success

16 January 2024

In recent years, environmental, social, and governance (ESG) reporting has gained significant traction, becoming a crucial aspect of corporate transparency and accountability. The European Union's Corporate Sustainability Reporting Directive (CSRD), that came into effect in 2022, further emphasizes the importance of ESG reporting by enforcing that large and/or listed companies (except listed micro-enterprises) annually disclose non-financial information related to their sustainability performance. As part of the CSRD legislation, companies are required by law to have limited assurance on ESG Reporting in financial year 2024.

The challenge of data

With the expanded scope of ESG reporting requirements, companies are confronted with the challenge of managing and governing the vast amount of data (potentially more than 300 KPI’s) needed to support their ESG disclosures.

Currently, companies in scope of the CSRD are becoming increasingly aware of what needs to be reported but are often neglecting the data aspect of it. As a result, a multitude of problems and inconsistencies emerge. Here is a non exhaustive list of possible issues that may come up:

- Inconsistent reporting and metric usage across departments

- Lack of trust in reporting due to poor data quality

- Uncertainty about the data used for metric calculations

- Vagueness about who to contact for any questions related to ESG reporting

- Errors in reporting dashboards due to changes in source data

- Lack of clarity about metric drivers impeding the alignment of ESG initiatives with overall business strategy

- Lack of assurance readiness: CSRD imposes audit requirements for the sustainability scope of the reporting

Evidently, a substantial amount of resources are lost by investigating the sources used for and the calculations made in ESG Reports and metrics, undermining the integrity of the different sustainability initiatives. Moreover, companies are obliged to report about their ESG practices on an annual basis. It goes without saying that having a clear ESG governance in place will prove to be beneficial.

The four pillars to streamline the ESG Reporting process

- Ownership & Accountability: Establishing ownership on ESG processes, metrics, dashboards and data is the first and fundamental step. Clear accountabilities ensure that responsible individuals oversee every aspect of ESG and become the go-to-person in case of questions or concerns. These individuals will play a crucial role in establishing the following three pillars.

- ESG data inventory & lineage documentation: This pillar requires a comprehensive understanding of all your data sources, encompassing both external partners and internal departments. Documenting catalog sources in one accessible place and registering the data lineage ensures transparency and traceability.

- Ensure accurate reporting and govern your ESG data: To eliminate confusion, it is essential to document the source data and the used metrics. Disclose basic documentation for source data and provide clear descriptions and designated ownership for all reported metrics in a centralized repository. Additionally, show how different metrics interrelate for a more comprehensive understanding.

- Data Quality; After documenting the data used for ESG metric calculations, and assigning clear accountabilities, prioritizing quality efforts becomes more straightforward. Having a good software or data quality tool is important, but to ensure proper trust in ESG data in the long term, it is imperative to have clear accountabilities assigned to both data and ESG related processes/metrics.

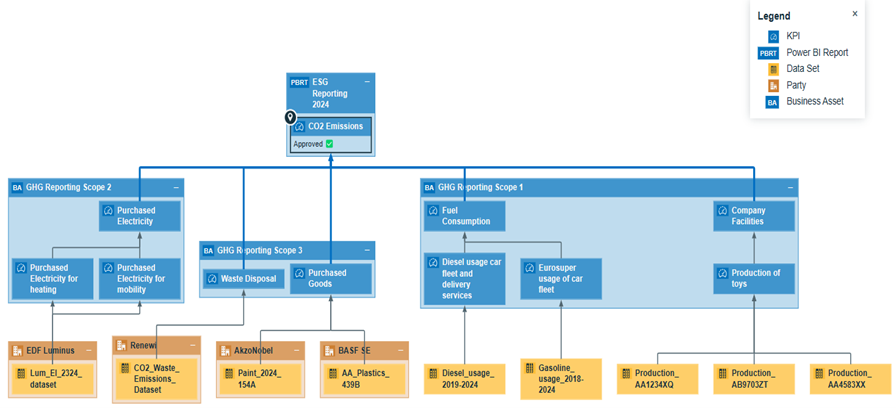

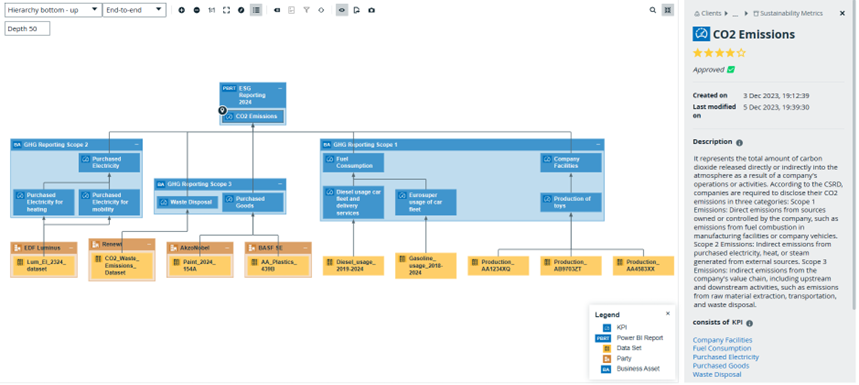

The previously mentioned points may appear distinct, yet they are intricately interconnected. To illustrate this, we've provided a simplified visual representation in Collibra, a chosen governance tool, depicting the relationships within one of the ESG indicators.

Conclusion

Robust ESG reporting is crucial in navigating the challenges posed by the CSRD. Establishing Ownership & Accountability, maintaining a comprehensive ESG data inventory, and prioritizing Data Quality are fundamental pillars for success. This integrated approach not only streamlines reporting processes but transforms sustainability reports into strategic assets, fostering operational efficiency and mitigating risks. Transparent reporting attracts socially responsible investors, builds stakeholder trust, and yields tangible cost benefits. In a landscape where ESG considerations are vital, embracing Data Governance practices is not just a compliance exercise but a crucial step in future-proofing organizations.